When it involves teaching and aiding youngsters to discover cash, there are a number of institutions of belief regarding when and also just how to approach it. Generally speaking, however, it is never ever prematurely (or too late) to aid youngsters to learn as high as they can about money, from what it is and just how it is gained, to the advantages of waiting as well as exactly how to invest it.

There are numerous methods and strategies offered for parents to utilize in order to assist their kids to find out about money, despite the child’s age. There are a wide variety of Net sites that contain games and also activities made to assist kids to learn more about cash. Parents can additionally turn to books that contain both functional recommendations and also fun methods for training youngsters concerning cash. Also, a great old-fashioned video game of Syndicate can function as a tool for mentoring kids about money. Nonetheless, despite the selection methods, approaches, and resources, most specialists concur that there is no true substitute for real-world understanding, particularly when it comes to learning about money.

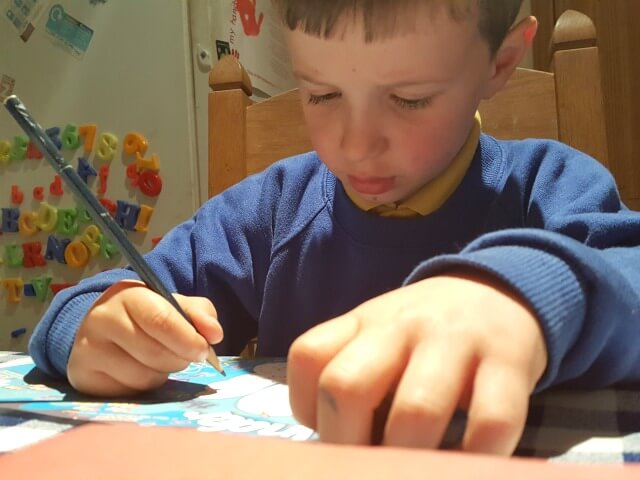

Youngsters can usually start learning more about cash once they are of school age or around 4 years of age. Moms and dads can assist younger kids (ages 4 to concerning 8) in begin discover money by appointing them small work to do around your house. We’re chatting really children, so the work has to be simple for them to do. Take into consideration options like making their bed or picking up toys after having fun with them. Whatever the work might be, parents can compensate their youngsters with quarters for their job. Making use of a piggy bank or a tally sheet can assist kids to track their incomes and also can help them expect to buy a brand-new dabble of the cash they have made by themselves.

As youngsters grow older, their requirements and also the decisions they need to make relating to money end up being extra complicated. Children ages 8 to 12 for example, can be offered extra freedom to make decisions on how to invest their cash. This age represents an ideal possibility for moms and dads to show kids about comparison shopping. At this age, moms and dads could additionally think about providing their kids a set allocation, or they can continue to pay youngsters for finishing certain tasks and work. Parents need to consider paying pupils for more difficult or atypical tasks such as trimming the grass or washing a car. Normal or expected tasks need to not be rewarded.

Teens and cash usually stand for a bad combination. This is typically the outcome of bad financial education and learning for parents. For kids 13 years of age and also older, it is crucial for moms and dads to be constant with how they award or “pay” their kids. Daily tasks should proceed, but parents ought to maintain the concept that they will just spend for jobs that go above and also beyond the child’s anticipated daily chores. Allowances can be enhanced to permit age-typical expenditures such as flicks or school-related occasions. Moms and dads ought to avoid the dangers of presenting kids to credit history or debit cards.

At this age, it is best to keep the money tangible, as introducing even older teens to charge cards can trigger them to lose sight of how cash is gained. When children no more see the cash leaving their pockets, they no longer take note of exactly how, or on what, it is invested. Read full article in this link for more tips on how to teach kids the value of money.